The Jordan Hotels Association discusses with the Greater Amman Municipality the implications of the Draft Building Tax Law on the hotel sector

Amman - Jordan

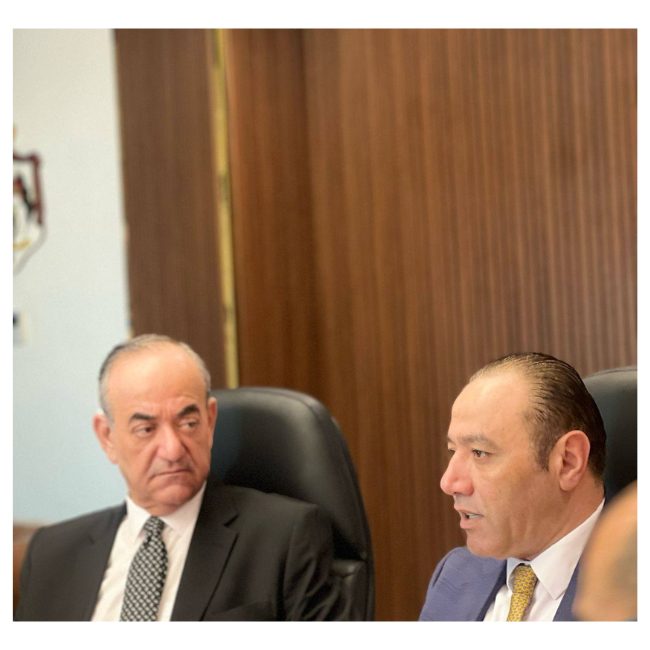

The Jordan Hotels Association held a consultative meeting with the Greater Amman Municipality to discuss the Draft Building and Land Tax Law for 2025. The meeting was attended by the Association’s Chairman, former Senator Abdul Hakim Mahmoud Al-Hindi, the Deputy City Director for Financial and Administrative Affairs at the Municipality, Samer Al-Yaseen, along with several officials from both sides.

During the meeting, the Chairman of the Association emphasized the importance of clarifying the tax calculation mechanism and the incentives included in the draft law. He stressed the need to avoid imposing any additional taxes or rates that would increase the burden on the hotel sector, which is already facing accumulated economic challenges.

Al-Hindi also underscored the necessity of prior coordination between both parties before issuing any new regulations or schedules that could impact hotel establishments.

For his part, Al-Yaseen explained that the new draft law does not introduce new taxes but rather adopts a modern valuation mechanism based on the nature of the property, its location, zoning classification, and administrative value. This replaces the previous rent-based estimation system, which was prone to subjective interpretation and inconsistent assessments.

He noted that the new system aims to achieve fairness and transparency through a direct electronic valuation process, conducted in cooperation with the Department of Lands and Survey.

Additionally, the Municipality’s team presented key incentives featured in the draft law, including support for green buildings and heritage sites, encouragement for the use of underutilized lands, and backing for renewable energy projects within the hotel sector, thereby enhancing its sustainability.

Members of the Association’s Board of Directors shared their observations and inquiries, requesting detailed tables outlining the method of tax calculation for hotels. They highlighted the importance of continued dialogue and consultation to ensure a fair and effective implementation that serves the interests of the hotel sector and maintains its competitiveness.

Board members also noted that initial indications from the draft law’s content suggest a positive direction toward achieving equity and promoting investment in the hotel sector, particularly with the move toward unified electronic assessment and the introduction of sector-aligned incentives.

The Association called for ongoing coordination and consultation between both sides to ensure the law is implemented fairly and smoothly, in a manner that supports the interests, stability, and competitiveness of the hotel industry in the local market.

Share On:

Useful Links

- - Ministry Of Tourism and Antiquities

- - Jordan Tourism Board

- - Aqaba Special Economic Zone Authority

- - Department of Antiquities

- - Tourism Police Department

- - Public Security Directorate

- - Royal Jordanian Airline

- - Ministry of Labour

- - Ministry of Investment

- - Ministry of Interior

- - Ministry of Foreign Affairs and Expatriates

- - Petra Development Tourism Region Authority

Jabal Amman, Tunis Street (Ammon Complex), Between 4th – 5th Circle Amman, Jordan

JHA © 2024. All Rights Reserved

Powered By Abr Al-kon